Stacc Mortgage Underwriting

Market leading advisory software for mortgage lenders

More than 70 banks and other lenders use Stacc Mortgage Underwriting, a specialised affordability and collaterals engine to support loan origination processes and provide thorough financial advice to consumers on a daily basis.

Stacc Mortgage Underwriting

Market leading advisory software for mortgage lenders

More than 70 banks and other lenders use Stacc Mortgage Underwriting, a specialised affordability and collaterals engine to support loan origination processes and provide thorough financial advice to consumers on a daily basis.

Stacc Mortgage Underwriting

Market leading advisory software for mortgage lenders

More than 70 banks and other lenders use Stacc Mortgage Underwriting, a specialised affordability and collaterals engine to support loan origination processes and provide thorough financial advice to consumers on a daily basis.

Trusted by 70+ banks & lenders and 2,000+ advisors daily

Advanced underwriting for mortgages

Stakeholders

Affordability

Collaterals Overview

Collaterals Matrix

Decision

Stakeholders

Affordability

Collaterals Overview

Collaterals Matrix

Decision

Business value with Stacc Mortgage Underwriting

Business value with Stacc Mortgage Underwriting

Transforming manual cases into scalable decisions

Deliver personalised financial insights

Accelerate complex credit decisions

Optimise collateral and exposure

Empower advisors with smart tools

Ensure compliance and transparency

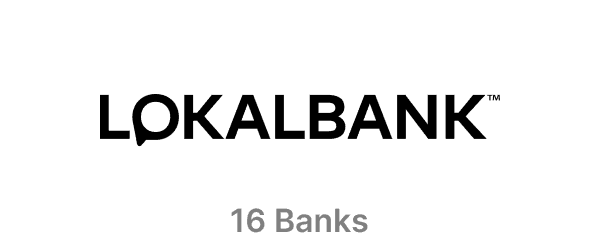

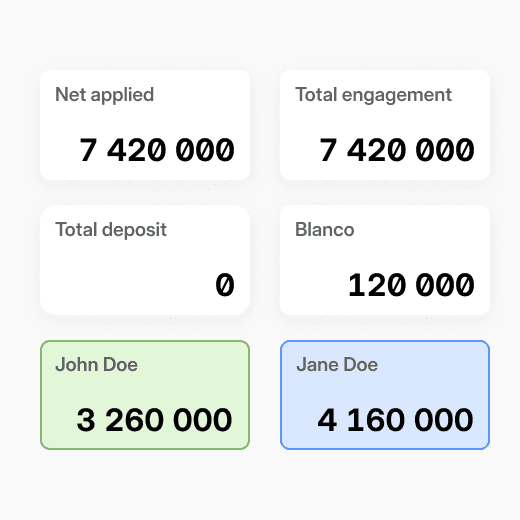

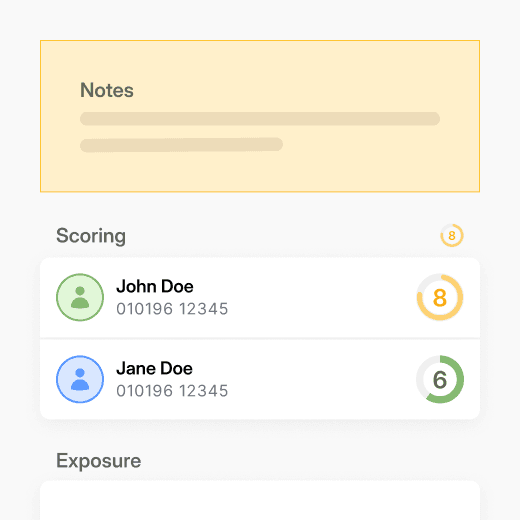

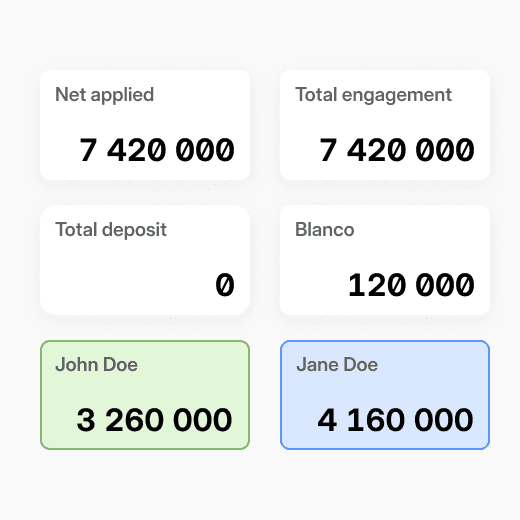

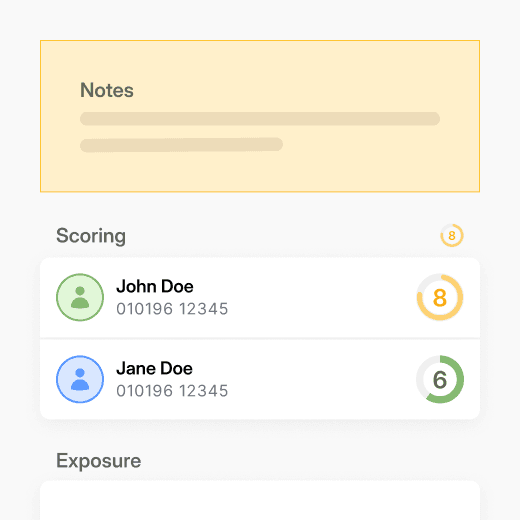

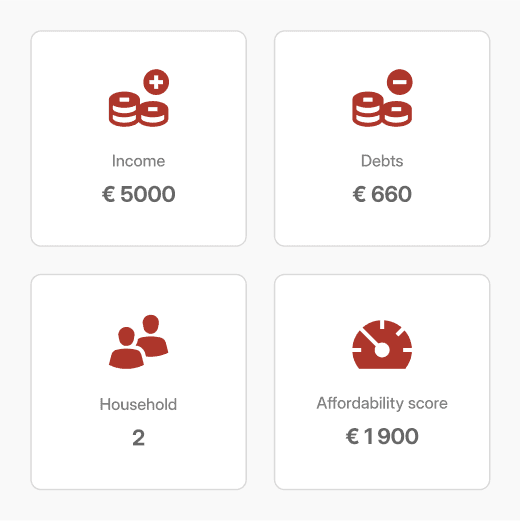

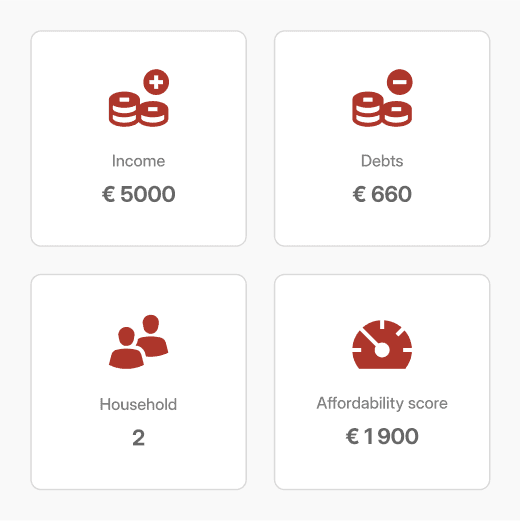

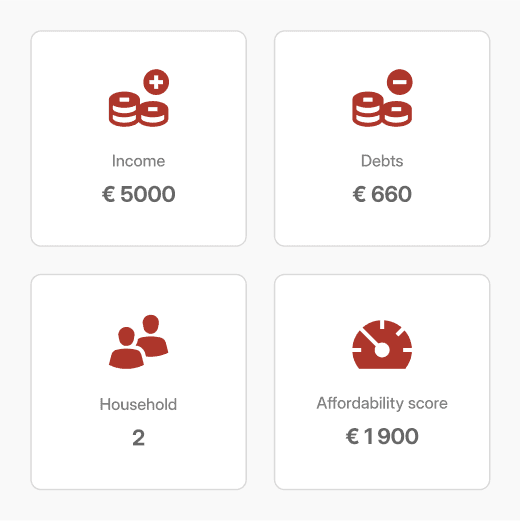

Tailor insights for every household

Stacc gives advisors a real-time, holistic view of each household’s financial situation by combining income, debt, assets, expenses and family structure. Key metrics like affordability and debt-to-income are calculated instantly, using both automated and advisor-supplied data—allowing the bank to provide relevant, data-driven advice that strengthens customer relationships.

Deliver personalised financial insights

Accelerate complex credit decisions

Optimise collateral and exposure

Empower advisors with smart tools

Ensure compliance and transparency

Tailor insights for every household

Stacc gives advisors a real-time, holistic view of each household’s financial situation by combining income, debt, assets, expenses and family structure. Key metrics like affordability and debt-to-income are calculated instantly, using both automated and advisor-supplied data—allowing the bank to provide relevant, data-driven advice that strengthens customer relationships.

Deliver personalised financial insights

Accelerate complex credit decisions

Optimise collateral and exposure

Empower advisors with smart tools

Ensure compliance and transparency

Tailor insights for every household

Stacc gives advisors a real-time, holistic view of each household’s financial situation by combining income, debt, assets, expenses and family structure. Key metrics like affordability and debt-to-income are calculated instantly, using both automated and advisor-supplied data—allowing the bank to provide relevant, data-driven advice that strengthens customer relationships.

Customer stories

Don't just listen to us

Hear how Stacc Mortgage Underwriting has helped our customers transform manual mortgage cases into scalable decisions.

Customer stories

Don't just listen to us

Hear how Stacc Mortgage Underwriting has helped our customers transform manual mortgage cases into scalable decisions.

Customer stories

Don't just listen to us

Hear how Stacc Mortgage Underwriting has helped our customers transform manual mortgage cases into scalable decisions.

Why Stacc Mortgage Underwriting?

The market leading underwriting engine

Credit-native solutions and expertise

Take comfort in working with 200+ credit and tech experts with more than 40 years of experience in the credit domain - focused on the advanced needs of mortgage providers.

We have done this hundreds of times. For decades. Stacc Advanced Underwriting for Mortgage dates back to 1981.

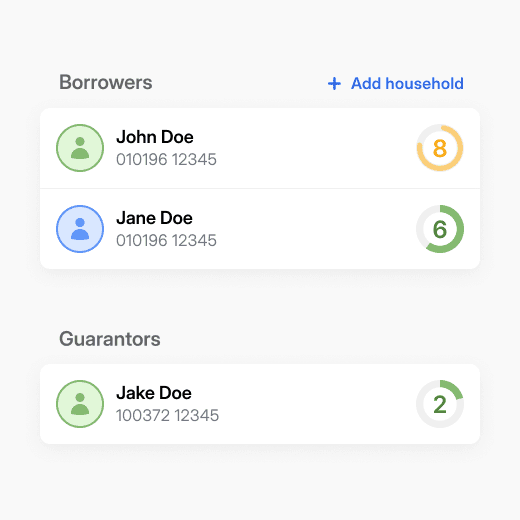

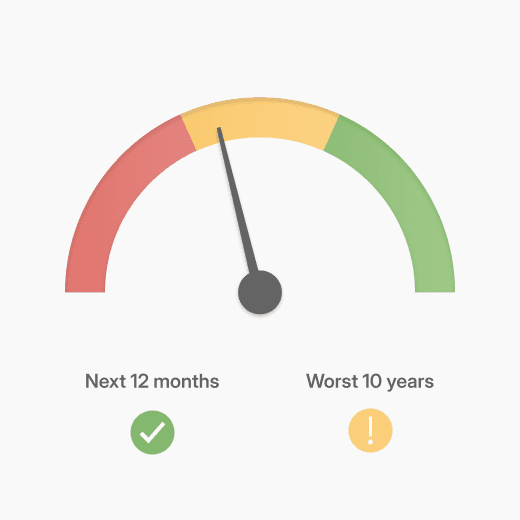

360° real-time affordability analysis

Advanced collaterals matrix

Cloud and API-native

Superior Time-to-Value

Credit-native solutions and expertise

Take comfort in working with 200+ credit and tech experts with more than 40 years of experience in the credit domain - focused on the advanced needs of mortgage providers.

We have done this hundreds of times. For decades. Stacc Advanced Underwriting for Mortgage dates back to 1981.

360° real-time affordability analysis

Advanced collaterals matrix

Cloud and API-native

Superior Time-to-Value

Why Stacc Mortgage Underwriting?

The market leading underwriting engine

Credit-native solutions and expertise

Take comfort in working with 200+ credit and tech experts with more than 40 years of experience in the credit domain - focused on the advanced needs of mortgage providers.

We have done this hundreds of times. For decades. Stacc Advanced Underwriting for Mortgage dates back to 1981.

360° real-time affordability analysis

Advanced collaterals matrix

Cloud and API-native

Superior Time-to-Value

360° real-time affordability analysis

A robust solution for modern mortgage advisory

Unique financial analysis tool, providing a 360° financial analysis of retail customers, particularly adapted to support credit and advisory processes related to mortgages and other retail credit products. Handle all combinations of financial analysis in the same solution. No more window juggling.

360° real-time affordability analysis

A robust solution for modern mortgage advisory

Unique financial analysis tool, providing a 360° financial analysis of retail customers, particularly adapted to support credit and advisory processes related to mortgages and other retail credit products. Handle all combinations of financial analysis in the same solution. No more window juggling.

360° real-time affordability analysis

A robust solution for modern mortgage advisory

Unique financial analysis tool, providing a 360° financial analysis of retail customers, particularly adapted to support credit and advisory processes related to mortgages and other retail credit products. Handle all combinations of financial analysis in the same solution. No more window juggling.

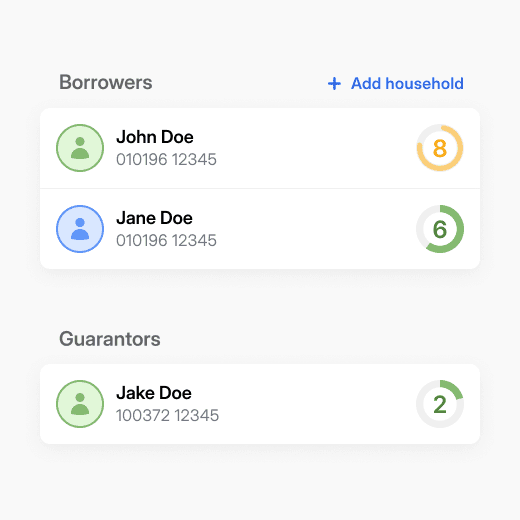

Any life situation

Applicant journeys

Moving in together

Households

Disability

Divorce

Unemployment

Having children

Guarantors

Separation

New economics

First home

Any financial analysis

Financial analyses

Current financial situation

Affordability calculation

Debt scenario simulation

Changed financial situation

Cost of living & liquidity

Risk tolerance

Future pensions

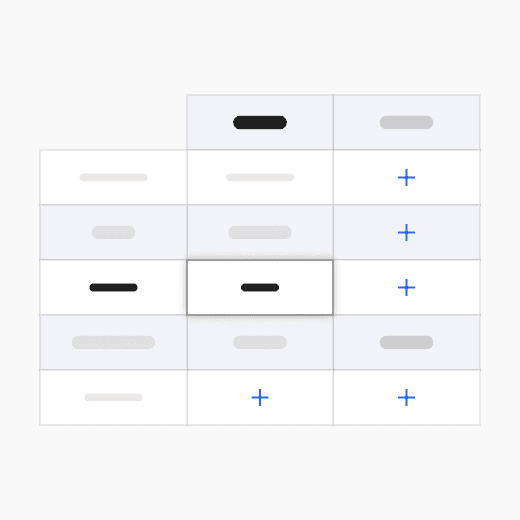

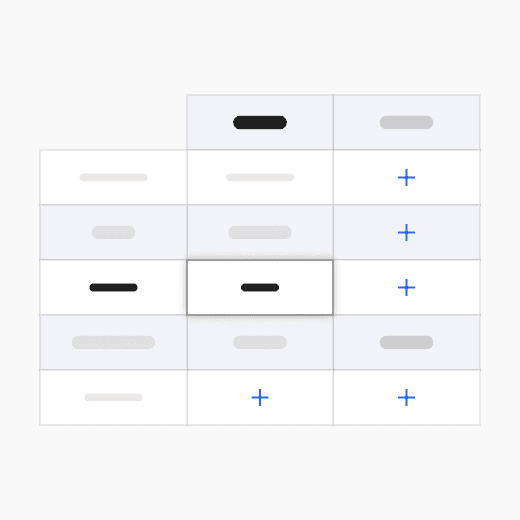

Advanced collaterals matrix

Connect loans, collateral and confidence

From intake to insight, Stacc Mortgage Underwriting lets advisors manage agreements and collateral with ease. The intuitive collateral matrix and clear exposure visuals help banks maximise security and lending potential with confidence.

Advanced collaterals matrix

Connect loans, collateral and confidence

From intake to insight, Stacc Mortgage Underwriting lets advisors manage agreements and collateral with ease. The intuitive collateral matrix and clear exposure visuals help banks maximise security and lending potential with confidence.

Advanced collaterals matrix

Connect loans, collateral and confidence

From intake to insight, Stacc Mortgage Underwriting lets advisors manage agreements and collateral with ease. The intuitive collateral matrix and clear exposure visuals help banks maximise security and lending potential with confidence.

Any agreement

Collateral agreements

Real estate

Housing cooperative share

Vehicle / Fleet

Movables

Aircraft

Ships

Purchase contract

Aquaculture

Generic

Accounts collateral

Securities collateral

Transport declaration

Suretyship

Any object

Collateral objects

Real estate

Housing cooperative share

Vehicle / Fleet

Movables

Aircraft

Ships

Purchase contract

Aquaculture

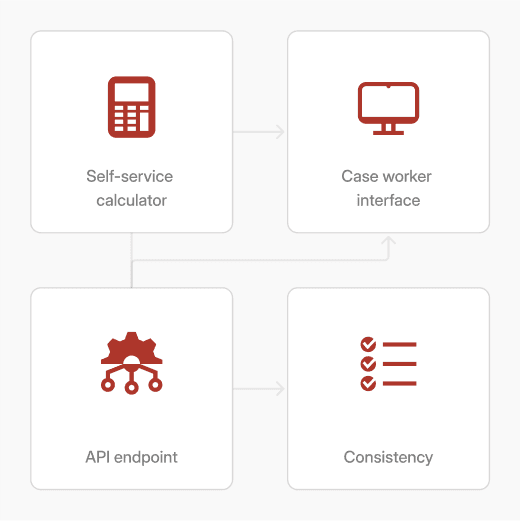

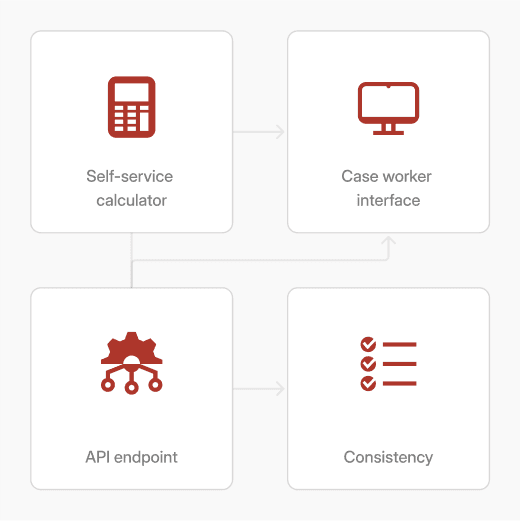

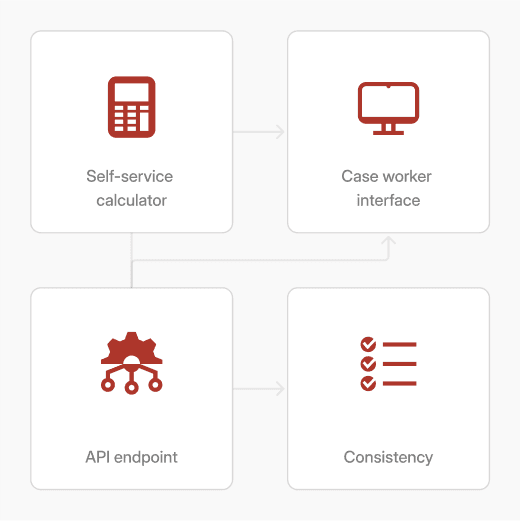

Stacc Affordability API

Affordability insights, delivered instantly

Make smarter credit decisions with the Stacc Affordability API — the trusted Nordic engine for liquidity assessments. Fast, transparent and consistent, it powers everything from self-service to underwriting with accuracy and control.

Stacc Affordability API

Affordability insights, delivered instantly

Make smarter credit decisions with the Stacc Affordability API — the trusted Nordic engine for liquidity assessments. Fast, transparent and consistent, it powers everything from self-service to underwriting with accuracy and control.

Stacc Affordability API

Affordability insights, delivered instantly

Make smarter credit decisions with the Stacc Affordability API — the trusted Nordic engine for liquidity assessments. Fast, transparent and consistent, it powers everything from self-service to underwriting with accuracy and control.

Built for precision, powered by context

Built for precision, powered by context

The Stacc Affordability API offers market-leading financial insights for mortgage and credit decisions.

The Stacc Affordability API offers market-leading financial insights for mortgage and credit decisions.

It analyzes everything from income and tax to household structure and assets to produce a highly accurate model – powering everything from loan applications to underwriting.

It analyzes everything from income and tax to household structure and assets to produce a highly accurate model – powering everything from loan applications to underwriting.

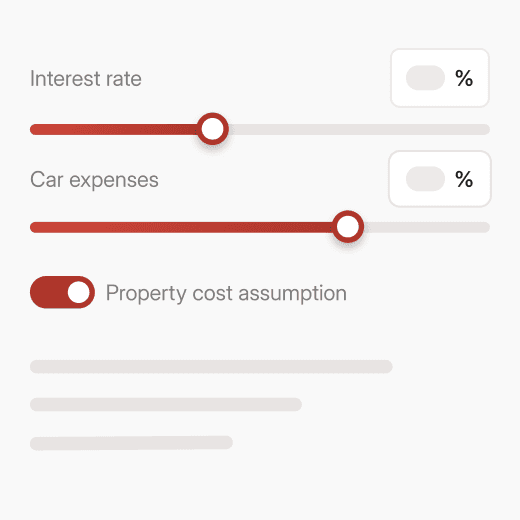

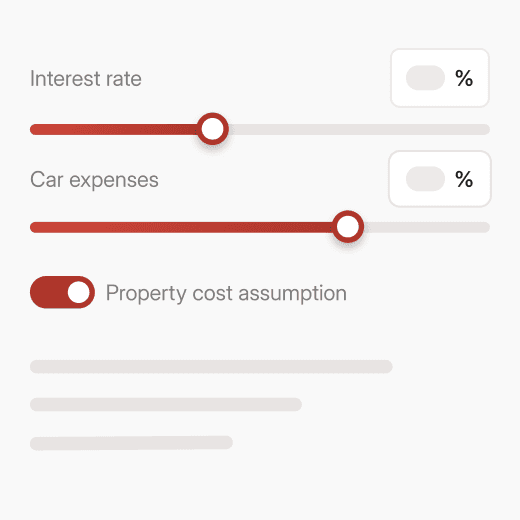

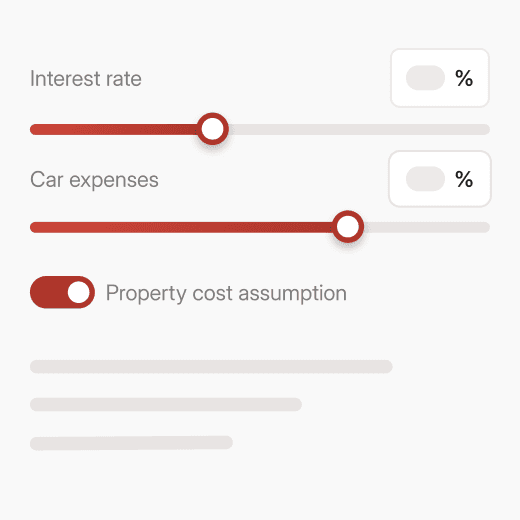

Self-service that empowers compliance and agility

Self-service that empowers compliance and agility

Take charge with the integrated Affordability Control Panel.

Take charge with the integrated Affordability Control Panel.

Edit default values, configure assumptions, and simulate “what if” cases – all with full auditability and version control. Adapt to market changes without a single code update.

Edit default values, configure assumptions, and simulate “what if” cases – all with full auditability and version control. Adapt to market changes without a single code update.

Consistency across channels

Consistency across channels

One model, all channels

One model, all channels

Ensure coherent customer journeys and compliant decisions with one shared affordability engine. Whether manual or automated, all channels rely on the same robust, tax-updated Affordability model – reducing complexity and risk.

Ensure coherent customer journeys and compliant decisions with one shared affordability engine. Whether manual or automated, all channels rely on the same robust, tax-updated Affordability model – reducing complexity and risk.

Explore other solutions by Stacc

Explore other solutions by Stacc

Explore other solutions by Stacc

Resources

Explore recent research

Resources

Explore recent research

Resources

Explore recent research

FAQ

What is Stacc Mortgage Underwriting, and what problems does it solve for banks?

What is Stacc Mortgage Underwriting, and what problems does it solve for banks?

What is Stacc Mortgage Underwriting, and what problems does it solve for banks?

How does the product support compliance with regulatory and internal credit policies?

How does the product support compliance with regulatory and internal credit policies?

How does the product support compliance with regulatory and internal credit policies?

Can the solution be customised to match our bank’s internal workflows and preferences?

Can the solution be customised to match our bank’s internal workflows and preferences?

Can the solution be customised to match our bank’s internal workflows and preferences?

What type of data integrations are supported with our existing core banking systems?

What type of data integrations are supported with our existing core banking systems?

What type of data integrations are supported with our existing core banking systems?

How does the system handle complex cases involving multiple stakeholders or households?

How does the system handle complex cases involving multiple stakeholders or households?

How does the system handle complex cases involving multiple stakeholders or households?

What types of collaterals and products are supported in the underwriting process?

What types of collaterals and products are supported in the underwriting process?

What types of collaterals and products are supported in the underwriting process?

What outputs or reports can advisors generate, and how are these used in the decision process?

What outputs or reports can advisors generate, and how are these used in the decision process?

What outputs or reports can advisors generate, and how are these used in the decision process?

Request a Demo

Ready to transform your mortgage underwriting?

Experience the modern and and intelligent value of Stacc Mortgage Underwriting

Request a Demo

Ready to transform your mortgage underwriting?

Experience the modern and and intelligent value of Stacc Mortgage Underwriting

Request a Demo

Ready to transform your mortgage underwriting?

Experience the modern and and intelligent value of Stacc Mortgage Underwriting