trusted by

Treasury Management for Real Estate

Our system helps you manage your treasury operations efficiently. It helps in managing various financial tasks such as debt management, liquidity management, risk management, investment management, and financial reporting.

All types of debt and interest derivatives can be managed in Escali Financials TMS.

This includes bonds, mortgage loans, credit facilities, syndicated loans, and construction loans. Future Rate Agreements and Interest swaps are also supported. The system calculates and posts automatically interest, installments, accruals, current portion of the debt, Mark-to-Market, and amortization.

It gives you a good overview of your loan portfolio including collaterals and financial covenants, future cash flows, counterparty risk, average interest, duration, maturity, and yield.

Internal loans, financing, and hedging can also be managed in the system. Internal lending can be mirrored as internal debt, so you only need to manage one loan. Loan agreements are also available directly from the system.

Liquidity and payments are also central elements in our TMS, and cash flow analysis and budgeting.

Features

External debt and Interest derivatives

All types of external debt and interest derivatives can be managed in Escali Financials TMS. This includes bonds, mortgage loans, credit facilities, syndicated loans, and construction loans. Future Rate Agreements and Interest swaps are also supported. The system calculates and posts automatically interest, instalments, accruals, current portion of debt, Mark-to-Market, and amortization. It also does all the interest fixes automatically.

It gives you a good overview of your loan portfolio including collaterals and covenants, future cash flows, counterparty risk, average interest, duration, maturity, and yield.

Collaterals and covenants

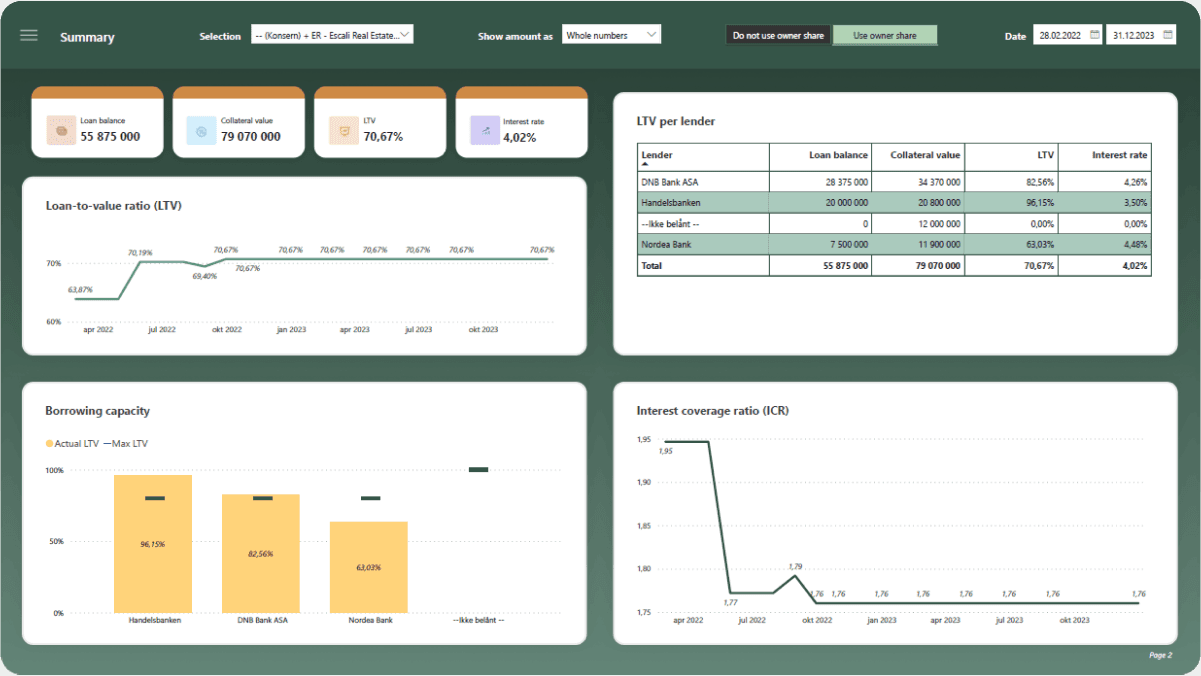

Keep track of all collaterals and financial covenants directly in the system. LTV (Loan-to-Value) / ICR (Interest coverage ratio) can be calculated in our tailored dashboard for covenants for real estate companies.

Internal bank

Internal loans, financing, and hedging can also be managed in the system. Internal lending can be mirrored as internal debt, so you only need to manage one loan. Loan agreements are also available directly from the system.

Liquidity, payments, and other features

The system can also be integrated with your bank balances if you want to monitor all available cash in one system. Together with funds and securities you will have a total overview of all your available liquidity. With all financial cash flows available in the system, together with rental income, you have a full overview of your liquidity needs.

The system includes budgeting and prognosis features, including cash forecasting.

Escali Financials TMS also handle treasury payments and investments in securities.

If your real estate company has properties in other countries, the system can manage FX derivatives such as forwards, swaps, spots, and options, including currency exposure.

A user-friendly solution

Intuitive

The interface is intuitive, and the menus are tailored for your requirements and needs. The system is easy to understand and learn.

Office friendly

Fully integrated with MS Office, you can easily export or link data to Excel or Power BI.

Integrated

No installation

No installations are needed. The system is delivered in the cloud, as Software-as-a-Service (SaaS) and support is included.